World News Desk

Learn the why behind the headlines.

Subscribe to the Real Truth for FREE news and analysis.

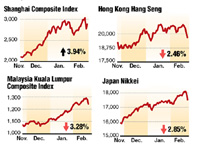

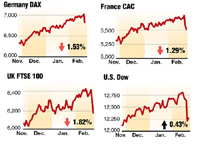

Subscribe NowFebruary 27, 2007, was the worst day in trading since 9/11. The Dow Jones took a 400-point plunge, closing with losses equaling approximately $632 billion.

Elsewhere, Asian and European countries reported falls at an average of 3%. China was the hardest hit—with its market dropping 9%—and was a main cause of worldwide stock market instability.

In the Chinese markets, rising consumer prices and rumors of a 20% capital gains tax on Chinese stock investments caused fears among Shanghai investors, which spread around the globe.

Stock markets have been rising to all-time highs over recent months, leading many analysts to say the market was moving too high too fast.

MCT

MCT

MCT

MCT

This is usually followed by a gradual “correction” in which quick gains even out to more realistic returns.

Ed Peters, chief investment officer at PanAgora Asset Management, said this about the event: “Corrections usually happen because of a catalyst, and this may be it. The move in China was a surprise, and when a major market has a shock it ripples through the rest of the market. With all the trade that goes on with China, there tends to be a knee-jerk reaction with that kind of drop” (AP).

Others blamed part of America’s stock market dive on a terrorist attack on a U.S. air base in Afghanistan during a visit by Vice President Richard Cheney.

Another reason for the heavy blow to the American Stock Exchange was the Dow’s computer system becoming overwhelmed with orders, causing it to be sluggish. When the problem was identified, the Dow was switched to a backup system. The point totals quickly caught up and a 178-point drop was registered within one minute.

China’s government refuted the rumor of increased taxes, and by February 28, Wall Street recovered slightly from the heavy blow of the previous day. The Dow Jones recovered 10% of its loss the next day of trading. A day after panicking investors around the world, China’s market recovered almost a third of its losses.

Regardless of whether the world’s stock markets rebound quickly from this fall, this event reveals China’s growing importance to the global economy. Instability in China can spell trouble for investors around the world.

The United States’ fragile economy is becoming more uncertain and is increasingly linked to other countries’ economies—especially China, which owns much of America’s debt.

In the past, when America caught a chill, the rest of the world caught pneumonia. How long will it be before “when China catches a chill…” becomes the new catchphrase?

When China experiences economic setbacks in the future, how will the rest of the world fare?

More on Related Topics:

- Many Countries Are Bouncing Back From the Pandemic but the Poorest Are Not, UN Says

- Gambling Boom: U.S. Casinos Set New Revenue Records in 2023

- A Record Number of Americans Can’t Afford Their Rent. Lawmakers Are Scrambling to Help

- Mexico Overtakes China as the Leading Source of Goods Imported by U.S.

- U.S. National Debt Hits Record $34 Trillion